How to set up a cash envelope system

Did you know that using a card (whether credit or debit) can lead to spending more than if you had spent cash? That’s because there is a sense of pain associated with forking over cash that you just don’t feel when swiping a card.

If you’re trying to get out of debt or spend less on your budget so you can invest, using cash is an awesome way to get there.

My story

I first heard about the envelope system from the personal finance guru, Dave Ramsey. We worked through Dave Ramsey’s Baby Steps to go from living paycheck to paycheck to having absolutely no debt and owning our house in full. We were able to do this by creating a monthly budget and by using cash for most of our purchases.

The pros and cons of using cash

This isn’t a fairy tale, however. It’s real life. As such, there are some awesome things about strictly using cash for purchases and there are some very cons.

Pros of using a cash envelope system:

- It makes budgeting easy. When you use your card in conjunction with a budget, you have to sit down with your receipts or online bank statement. You calculate how much you’ve spent so far in each category and how much you have left to spend. With cash, you just open the envelope and count how much money is left.

- It creates a visual reminder when money is getting low. It’s pretty easy to spot the difference between ten $20 bills and two $20 bills. This affects your spending habits as the month nears to a close.

- Cash makes it easy to “borrow” from another budget category. Some months we spend less on gas but more on food. I don’t stress about each category perfectly zeroing out at the end of the month, so long as the cash as a whole zeroes out.

- It helps you spend less. You might think twice about throwing an impulse item into your cart if you know it’ll make the end of the month rough.

- It makes it easy on your willpower. I have as much willpower as a sack of potatoes (which pretty much means I have none). You can’t pay for a frivolity with an empty envelope.

Cons of using a cash envelope system:

- You have to remember to bring it. I can’t tell you how many times I pulled in the grocery store’s parking lot only to realize my cash envelopes were still at home. I’d drive all the way home, pick up the envelopes, then return to the store.

- You have to say no to some things. Want to go out to eat but only have $5 left in the food envelope and a fridge full of food? It can be hard to say no to fun things and instead stick to the budget.

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links, at no extra cost to you. Please read full disclosure for more information.

How to set up a cash envelope system

What you need:

- Envelopes (5-7 is a good number to start)

- Coupon holder

Both of these items can be found at the dollar store, Walmart or on Amazon.

Optional: You can also get wallets designed for the cash envelope system.

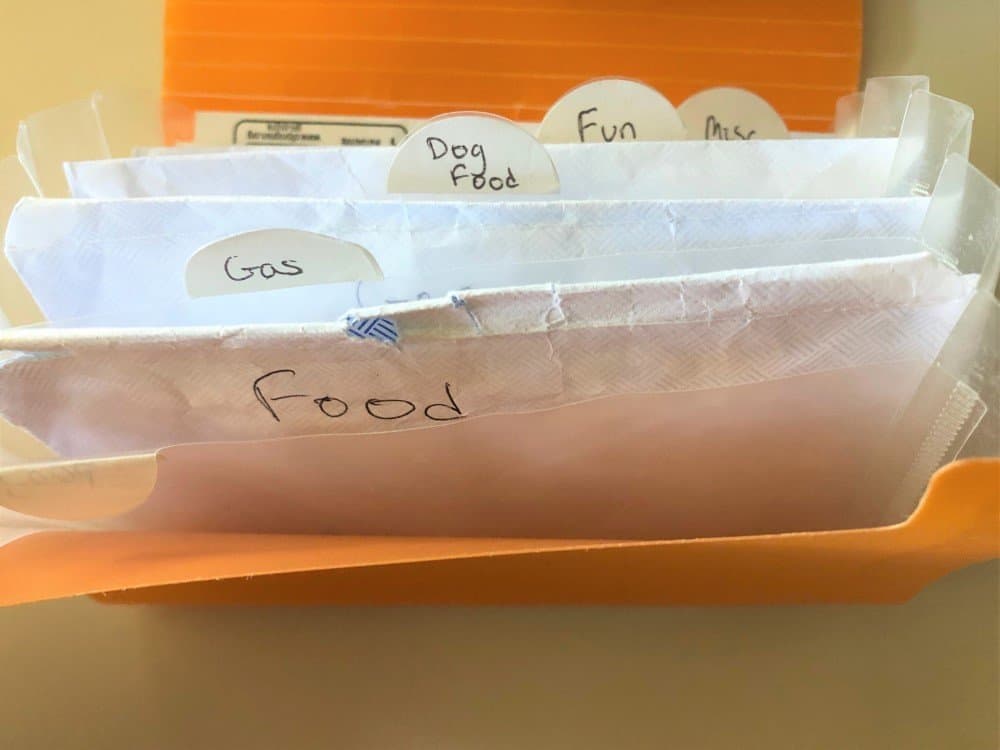

Categorize the envelopes

On each envelope, you’ll want to write a specific category. Here are some common categories:

- Groceries

- Gas/Transportation

- Medicine

- Clothing

- Home maintenance

- Pet food

- Donations

- Fun

- Misc.

Put envelopes into the coupon holder

You can organize the envelopes by what is used most frequently. For example, the grocery envelope could go right up front with the gas envelope right behind it.

A word about the miscellaneous envelope

Misc is an important envelope as we are all human and thus make mistakes. If you forget about a certain expense, you can use the misc envelope to still be successful with your budgeting goal. If you don’t use it one month, you can adjust the budget for the next month (i.e. take the $50 that would normally go to the misc envelop and redirect that towards an extra debt payment).

That’s it!

It’s easy peasy, mama! But don’t let the lack of complication fool you. This little system is so powerful with helping you be the boss of your money. Go forth and crush those financial goals!